[ad_1]

One of the important activities in the accounts payable (AP) processes is invoice matching. Traditional approaches to this key task can cost businesses time, effort and human resources. Using innovative technologies and automated tools can optimize invoice compliance to provide additional leverage and value for business.

This article provides detailed information on invoice compliance, different types, the need for touchless invoice processing or invoice management and its various benefits.

What is invoice matching?

Invoice matching is an accounts payable process that checks and compares purchase order (PO) information with vendor invoices and product receipts.

When an organization wants to use a vendor’s goods or services, it places an order with detailed requirements. Upon delivery of the requested goods or services, a product receipt is issued by the purchasing organization. The seller then issues an invoice for payment clearance. This is when the invoice is matched.

Invoice matching ensures that there are no errors or discrepancies between the PO and the invoice. This facilitates prompt payment of vendor invoices and prevents vendor fraud and fraudulent invoice payments.

What is deviation?

Referred to as an invoice exception, a deviation occurs when there is a discrepancy between the details of the invoice and its supporting documents, such as a PO or goods/product receipt.

Deviations can be of two types – quantity and price

- quantity deviation: Refers to a discrepancy between the PO and the billed invoice in the quantity or quantity of items

- price deviation: Refers to the discrepancy between the value specified in the PO and the value specified in the invoice.

Identifying and reconciling deviations can be a challenging task for the AP department. Deviations must be evaluated to determine whether they fall within tolerance limits in order to continue processing the invoice or return the invoice to the vendor for correction.

A tolerance level refers to the small variation that can occur in percentages or amounts on an invoice. Invoices that exceed the tolerance level are placed on hold and sent to the vendor for correction.

Looking to automate your manual AP processes? Book a 30-minute live demo to see how Nanonets can help your team implement end-to-end AP automation.

Need for invoice matching

Let’s find out why invoice verification or compliance is so important for businesses.

Invoice matching ensures that vendor invoices can be verified against supporting documents before payments are released. It helps businesses:

- Confirm that payments are made only for valid goods or services received from the seller

- Maintain faster and more accurate release of payments

- Promote better transparency by eliminating errors and double payments

- Track payment records for multiple vendors

- Better prepare for company audits

Different businesses may follow different ways of matching invoices, as discussed in the section below.

Ways to match an invoice

The invoice matching process in organizations is usually done in the following ways: 2-way matching, 3-way matching and finally 4-way matching.

Invoices are validated against other related document workflows, which may include purchase orders, goods receipts, and inspection sheets. These matching paths also check for invoice discrepancies and tolerance levels that must be resolved before the invoice is cleared for payment.

2 ways to match

Two-way matching is a simple and common way to verify invoices. It includes matching invoices to purchase orders, as well as checking tolerances. If the invoice meets the required criteria, then it is scheduled to be paid.

3 ways to match

3-way matching is the most popular method of invoice matching. This involves a three-step process. The invoice is checked against the details specified in the purchase order and also upon receipt of the goods. Once the tolerance level is met, an invoice is prepared for payment.

4 ways to match

More complex than 2-way and 3-way matching, 4-way matching involves an additional step of validation. This requires matching invoices orders, goods receipts and inspection sheets.

When the goods are delivered, the receiving department checks the quantity and issues an inspection slip confirming that the quantity received is accurate. Therefore, only an invoice that matches the PO, goods receipt, tolerance and check sheet will be considered eligible for payment.

These invoice matching methods ensure that companies only pay for the goods/services ordered and received. It also protects against false invoices and payment errors, allowing businesses to better control their relationships with third parties.

Set up seamless AP workflows and streamline the payments process in seconds. Book a 30-minute live demo now.

Compliance of invoices with contracts

In addition to invoice matching methods, certain purchases can be made using the contract matching process. Also referred to as a non-PO invoice, this type of invoice is used for recurring or utility payments that occur in a cycle.

In contract matching, the invoice is compared and verified against the existing contract. Examples of such contract purchases may be monthly utility bills (electricity, water, etc.), building rent and maintenance fees, advertising costs, legal or consulting services, and more.

This type of match is subject to an internal invoice approval process. If the contract matches and is approved, then a non-PO invoice will be scheduled for payment.

This eliminates the need for matching invoices to purchase orders and other supporting documents. It also facilitates early settlement of recurring payments, saving time, effort and costs.

What is automatic invoice matching?

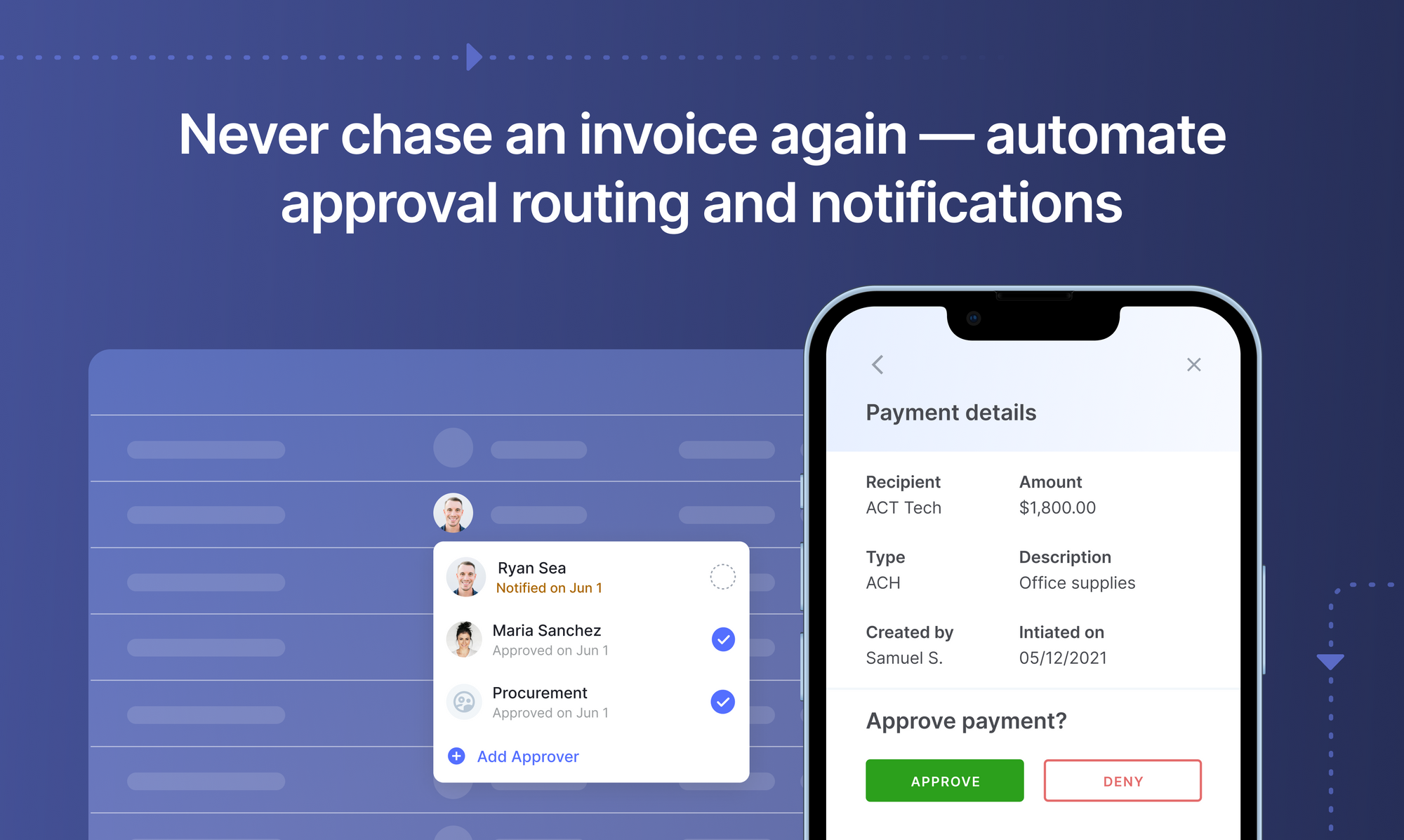

Automatic invoice matching refers to the digitization of the company’s invoice matching process with the help of advanced tools and technologies; Invoices are processed automatically, without the need for human intervention.

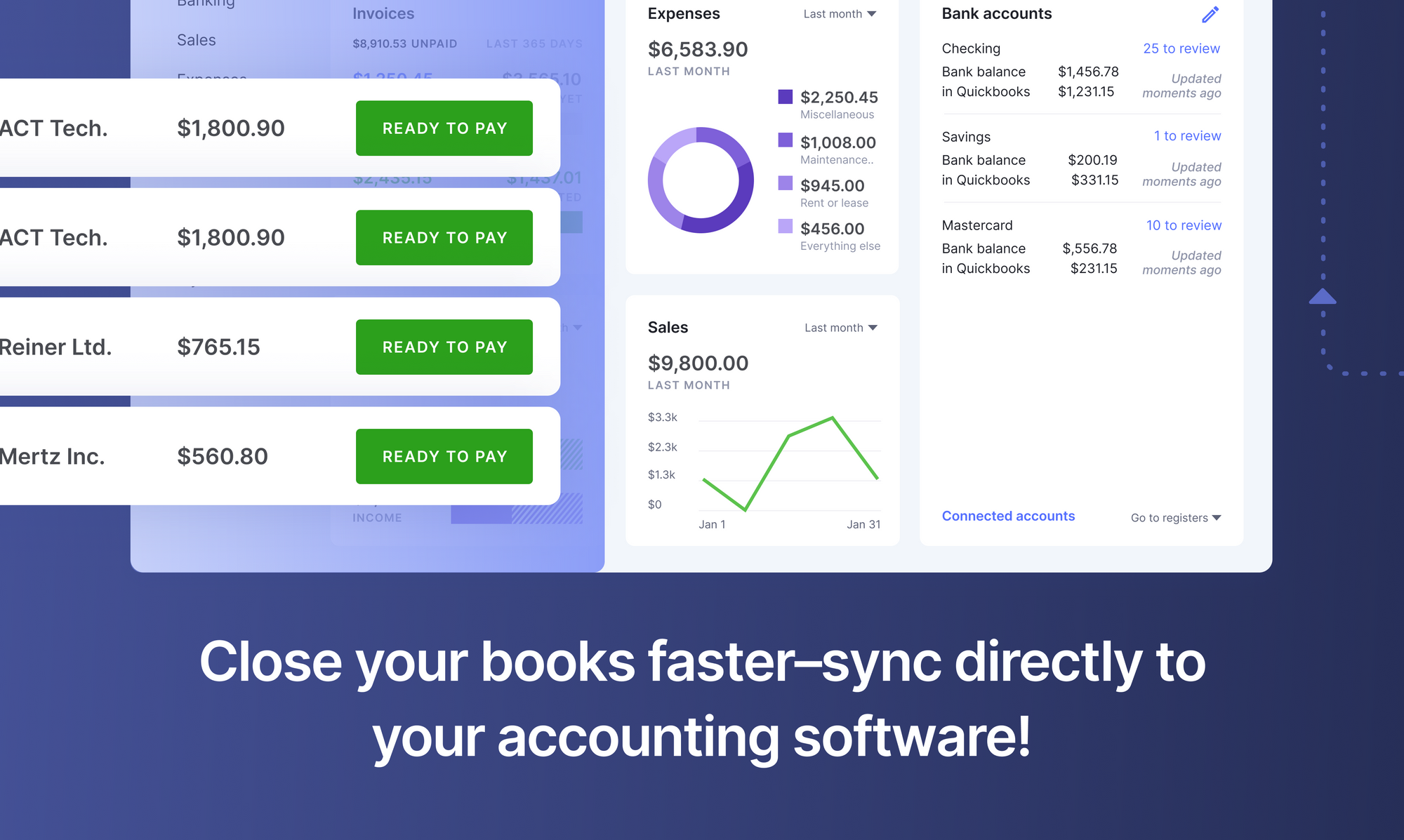

Automated invoice matching technology can transform the way AP departments work. Incoming invoices are scanned, digitized, matched by algorithms and checked against tolerance parameters, and if approved, processed for payment – all without human intervention.

The task of verifying or matching invoices and processing them using automation can bring many benefits. AI-based automation technologies such as OCR and RPA can enhance touch-free invoice processing to be efficient and error-free.

Book this 30-minute live demo for the last time you have to manually enter data from invoices or receipts into your ERP software.

Using artificial intelligence in automatic invoice matching

Using machine intelligence to handle processes can make complex tedious work simple and easy. AI-driven technologies such as OCR and RPA can be effective tools for automating AP processes and improving business efficiency.

Optical character recognition

OCR is a technology that reads and extracts information from digital documents for editing. Useful for industries with large volumes of data, OCR capabilities using artificial intelligence are a boon for AP automation.

OCR can perform efficient data capture by extracting relevant data. It then routes it automatically to match the invoice PO. After this step, the invoice matching process can be completed with a 2-, 3-, or 4-way match. All this reduces the effort, time and cost of manual tasks, which ensures better process efficiency.

But while OCR can make a huge contribution to optimizing the automation of AP processes, OCR alone may not be enough to complete the automation process. Using other powerful technology along with OCR may prove more beneficial to achieve complete automation of the process.

Robotic process automation

Robotic process automation is a popular and useful software technology that can act as a virtual assistant along with OCR to automate digital processes. The software allows users to create “bots” that mimic human actions.

These reliable robots are used in many industries to work 24/7 with high speed and precision. By interacting with system applications, these bots can automatically capture, extract, and analyze cognitive data just as humans do. In addition, they can communicate and route the extracted data to the appropriate processes to initiate precise action within seconds.

RPA with OCR can assist the AP invoice matching process with speed, accuracy and reduced time frames from invoice receipt. It uploads, scans, extracts information, initiates 2-, 3-, or 4-way matching, checks established tolerances, and flags invoices for correction or payment processing.

Advantages of automatic invoice matching

Automating invoice matching helps simplify the processing of invoices for payments. Along with eliminating the need for human intervention, the complications of document maintenance and manual validation are also eliminated.

Some of the important advantages of touchless invoice processing are:

- Time saving – Manual invoice matching is tedious and time-consuming. Checking invoice details individually and confirming 2, 3 or 4-way processes is time-consuming. Hence, it allows company employees to devote their valuable time to other key tasks and improve overall productivity.

- accuracy – AP process automation reduces the frequency of errors and ensures a smooth flow of work between processes. Discrepancies or inconsistencies are easily identified and only when the invoice is cleared at all levels is it scheduled for payment.

- Protection against duplicate and fraudulent invoices – Automating invoice matching involves consistent checking between invoices and supporting documents. Any exceptions are also detected and flagged for manual verification. This provides protection against fraudulent or duplicate invoices and better business control.

- Facilitates the relationship with the seller – Automating invoice processing can quickly match invoices to purchase orders and expedite faster payments to keep suppliers happy. In turn, businesses can also benefit from better contract offers and early payment discounts for increased profitability.

- Effective cost analysis – Touchless invoicing provides insight into individual line items, helping to identify those that offer the highest value. This reliable data facilitates better cost analysis and selection of appropriate vendors to bring more value to the company.

- Good for auditing – Invoices along with other supporting documents are mandatory for the audit. Using automatic invoice matching provides purchase orders, goods receipts, inspection slips and invoices in a digitally centralized location that is easily accessible during audits to speed up the process.

conclusion

Reconciling and processing accounts payable invoices is a complex process. AI enabled technology can provide leverage for businesses through customizable automation. Through automation, companies can use document management workflows to seamlessly integrate, create better transparency, maintain good business relationships for optimized business efficiency and growth.

[ad_2]

Source link